Pag-IBIG Fund declares record-high dividends

THE HOME Development Mutual Fund or Pag-IBIG Fund has declared a record-high P55.65 billion in total dividends for its members’ savings in 2024.

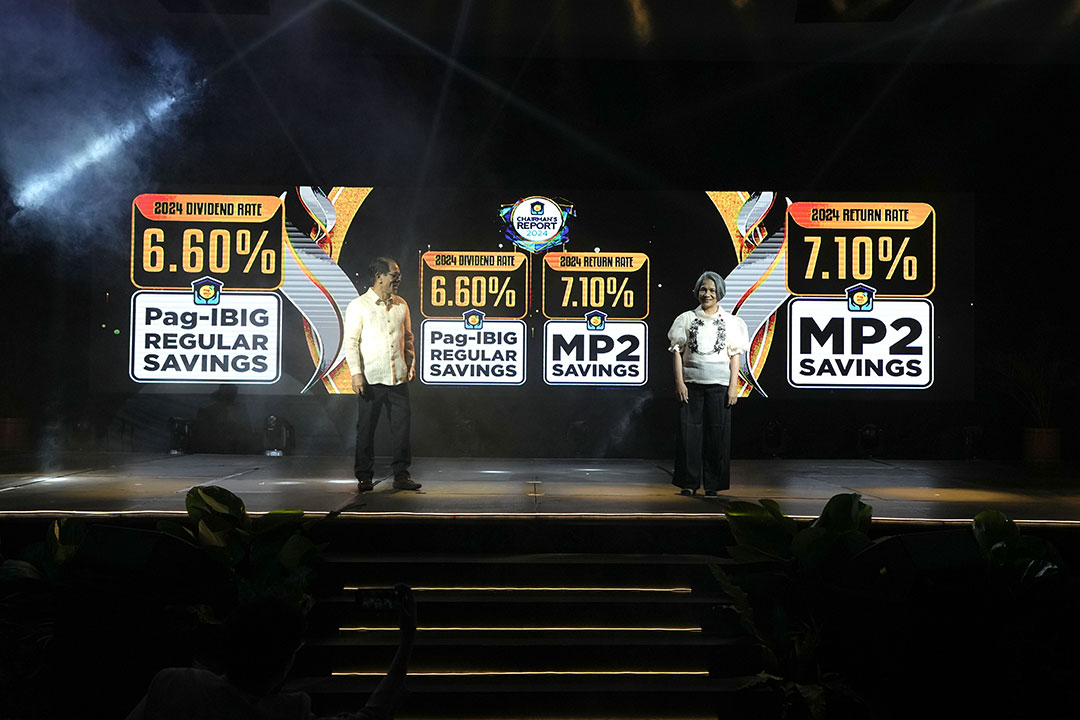

In a statement, Pag-IBIG Fund said this brought the dividend rate for its regular savings to 6.6%, while the rate for its modified Pag-IBIG 2 (MP2) savings went up to 7.1%.

The regular savings account is available to Pag-IBIG members who are currently employed or self-employed. The MP2 savings account is a voluntary savings program that offers higher dividend rates and has a five-year maturity period.

The Pag-IBIG Fund’s board of trustees approved that 82% of net income or P55.643 billion be declared as dividends for its members. This was higher than 70% of net income usually mandated to be declared as dividends.

The Pag-IBIG Fund’s net income reached a record P67.52 billion in 2024, up by 36% from P49.79 billion last year driven by higher loans, collections, and investment returns.

“Pag-IBIG Fund has once again marked 2024 as one of its best-performing years, achieving record highs in both total assets and net income,” Department of Human Settlements and Urban Development Secretary Jose Rizalino Acuzar was quoted as saying.

“With our strong performance, sound investments and robust finances, we are well-equipped to continue providing our members with responsive benefits and advance our efforts under the Pambansang Pabahay para sa Pilipino Program (4PH), ensuring that more Filipino workers can access affordable homes,” he added.

Pag-IBIG Fund Chief Executive Officer Marilene C. Acosta said in a speech on Thursday that the fund released P129.73 billion in home loans to 90,640 members last year.

The agency also collected P132.81 billion in membership savings, of which P73.74 billion were voluntarily saved under Upgraded and MP2 savings accounts.

Around P70.33 billion in cash loans or short-term loans were also disbursed to more than 3.21 million members.

The agency also extended P20 billion in approved developmental loans for 18,000 under the 4PH Program. It was able to onboard 54 partners under the program and grow the housing fund to about P5 billion from P3 billion.

“We also aim to empower at least 110,000 more families to achieve their dream of home ownership through our Pag-IBIG housing loan and almost 10,000 of our members to enjoy the comfort of their own home under the 4PH program,” Ms. Acosta said.

The agency’s total assets increased by about P75 billion to a record high of P1.069 trillion as of end-2024.

“By the end of this year, we expect total assets to reach P1.18 trillion,” Ms. Acosta said.

She added that Pag-IBIG Fund aims to add at least 1.5 million new members this year. The fund ended 2024 with 17 million members. — AMCS