More meaningful protection for a more secured future

In the quest for a fulfilling future, one should plan ahead, work hard, and save earnestly towards turning their dreams for themselves and their loved ones into a reality. But, for many, times of uncertainty and spontaneity often occur, where piled-up expenditures and sudden ailments can hinder one from achieving that fulfilling future.

In a research study commissioned by Cocolife, health and finances lead the top concerns of Filipinos, both at 61%. Developing illnesses and health emergencies carry the stress of financial strain, especially without prompt support and adequate protection.

Furthermore, among top healthcare priorities of the Filipinos surveyed in the study, hospitalization is placed first by the majority, comprising 30%, followed by emergency medical services (21%), and medicine expenses (13%) — areas where financial difficulties are mostly felt.

Preemptive measures such as exercise and proper diet, coupled with financial discipline, can definitely help individuals remain productive and stay afloat, but what would one do in a sudden twist of fate where self-care alone cannot suffice? How does one still make sure that everything goes well according to plan?

Recognizing the need for more meaningful protection among Filipinos, Cocolife, the first ISO-certified Filipino-owned stock life insurance company in the Philippines, aims to make sure individuals and families are well taken care of no matter what life throws in one’s way with its Alagang Cocolife brand of care.

“For Cocolife, it is our duty to serve our clients with the best insurance products, life and healthcare insurance, together with the 24/7 customer servicing to cater our clients’ needs, especially during these most trying times,” President and Chief Executive Officer Atty. Martin Loon stated, emphasizing the company’s commitment to taking care of fellow Filipinos in times of need.

Such commitment is shown by its pioneering Cocolife Aruga plan, which offers results-oriented health coverage beyond usual lists of defined illnesses.

Taking financial and health protection further, Cocolife has also introduced its enhanced Critical Illness Benefit and Hospitalization Income Benefit Riders as well as its newest health insurance products, Cocolife Agapay and Cocolife Kalinga.

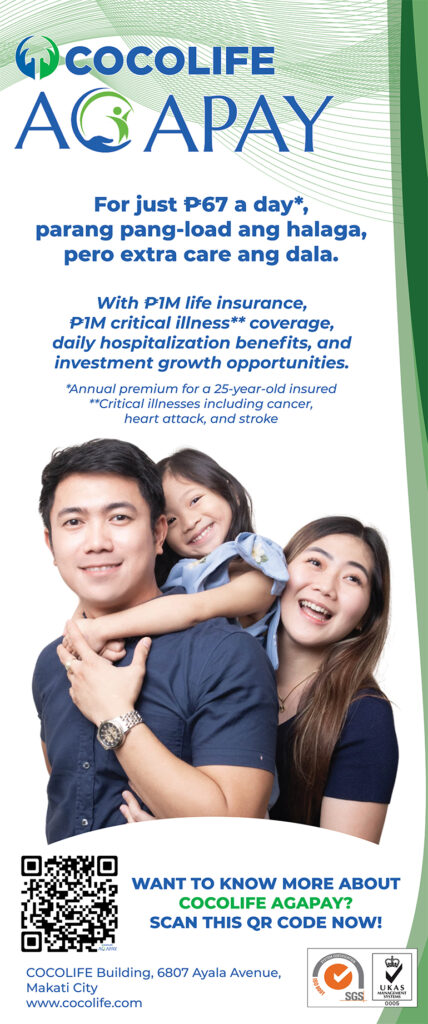

Most of the time, preparing for the future entails having plans A, B, and C to implement regardless of the situation. One can now have a solid plan in their suite with Cocolife Agapay, an investment-linked life and health insurance plan that promises to help individuals look out for themselves and their loved ones.

With its affordable premiums, Cocolife Agapay helps clients save for uncertainties for just P67 a day. In case the client’s condition becomes critical and medical costs consequently surge, Cocolife Agapay gives Critical Illness Coverage, where the client will be a recipient of a lump-sum payout for any of 36 covered critical illnesses, which includes cancer and stroke. If the client is unable to pay premiums out of disability and inability to continue work, Agapay still ensures they are still covered.

Agapay also provides an optional savings path where one can accumulate their funds to either support their hospital aftercare or their long-term ambitions.

Furthermore, if the client stays loyal to their policy, they will receive a loyalty bonus starting at the 10th year and every five years thereafter, adding value to the client’s long-term plan.

Cocolife Kalinga, meanwhile, aims to make insurance plans much more affordable for Filipinos. For just P20 a day, Cocolife Kalinga guarantees the client a simple term insurance plan that is certain to provide financial support when the client needs it the most.

The plan includes hospitalization income benefit, wherein the client is entitled to a daily cash assistance for each day of confinement due to illness, critical disease, or injury. The plan also offers flexibility, making it possible for the client to match their budget and goals with package options providing coverage for 10 years, 20 years, or until the age of 65. Similarly, it provides the client efficient renewal as there are no additional complicated steps required.

The plan also guarantees life insurance protection, which is 100% equal to the plan’s face amount in case of a client’s untimely passing. Cocolife Kalinga also has critical illness coverage and waiver of premium due to disability.

Carrying a vision of building a better nation through empowering Filipinos to achieve a more financially secure future, Cocolife pledges to guide clients towards a more improved and secured future through diverse options, like Cocolife Agapay and Cocolife Kalinga, that aptly match Filipino’s pressing needs and immediate resources.

“We assure you that Cocolife will provide you with only the highest quality of service,” Atty. Loon reiterates. “It is a commitment that made us the first ISO-certified life insurance company in the Philippines.”

Discover more about Cocolife Agapay at https://www.cocolife.com/cocolife-agapay/ and Cocolife Kalinga at https://www.cocolife.com/cocolife-kalinga/. For inquiries, email customer_service@cocolife.com.

Discover more about Cocolife Agapay at https://www.cocolife.com/cocolife-agapay/ and Cocolife Kalinga at https://www.cocolife.com/cocolife-kalinga/. For inquiries, email customer_service@cocolife.com.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by publishing their stories on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and get exclusive content through www.bworld-x.com.