Debt yields end mixed amid market volatility

YIELDS on government securities (GS) were mixed last week amid broad market volatility due to developments at home and overseas, with the peso hitting a new record low and the US Federal Reserve adopting a cautious tone.

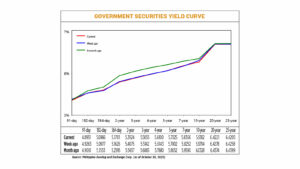

GS yields, which move opposite to prices, declined by an average of 0.76 basis point (bp) week on week at the secondary market, according to data from the PHP Bloomberg Valuation System Reference Rates as of Oct. 30 published on the Philippine Dealing System’s website.

Philippine financial markets were closed on Oct. 31 for a holiday.

At the short end, yields on the 91- and 182-day Treasury bills (T-bills) went down by 3.12 bps (to 4.8951%) and 0.11 bp (5.0966%) week on week, respectively. Meanwhile, the rate of the 364-day T-bill rose by 1.55 bps to 5.1781%.

At the belly of the curve, rates of the two-, three-, and four-year Treasury bonds (T-bonds) dropped by 1.51 bps (to 5.3924%), 0.87 bp (5.5055%), and 0.43 bp (5.6100%), respectively. Meanwhile, the five- and seven-year bonds climbed by 0.23 bp (to 5.7025%) and 1.14 bps (5.8366%), respectively.

Rates at the long end declined, with the 10-, 20-, and 25-year T-bonds falling by 4.12 bps (to 5.9382%), 0.57 bp (6.4221%), and 0.53 bp (6.4205%), respectively.

GS volume traded surged to P70.02 billion as of Oct. 30 from P28.52 billion a week prior.

“[The] volatility with regards to the foreign exchange moves spilled over in the local bond markets as well, especially when the peso hit all-time low levels,” Dino Angelo C. Aquino, vice-president and head of fixed income at Security Bank Corp., said in an e-mail.

“Rates are relatively elevated at current levels, with the 10-year bond still trading at around 5.9% as recent political noise along with the weakness of the local pair added premium to current GS yields, especially in the longer-dated maturities.”

On Oct. 28, the peso logged a new historic low of P59.13 against the dollar. It also fell to an intraday low of P59.26 during the Oct. 29 session but managed to recoup its losses.

The local unit closed at P58.85 on Oct. 30, down by 16 centavos from the prior day and by 22.5 centavos from its Oct. 24 finish.

“The Fed cut was highly anticipated and priced in by both the bond and the foreign exchange markets. Hence, despite the perceived ‘hawkish cut’ by the Fed, it drew very minimal reaction in the aftermath of the event,” Mr. Aquino added.

“The Fed’s 25-bp cut provided some strength to the local currency despite reaching historic lows [last] week. However, bond yields mostly moved in mixed directions on further rate cuts and upward risks to domestic inflation,” a bond trader said in an e-mail.

On Wednesday, after the Fed’s policy-setting committee voted 10-2 to lower its benchmark interest rate to the 3.75%-4% range, Fed Chair Jerome H. Powell delivered an unusually clear warning to markets: given “strongly differing views” about how to proceed in December, he said, a rate cut was “not a foregone conclusion, far from it,” Reuters reported.

Financial markets pared what had been near-certain pricing for a December rate cut after Mr. Powell’s remarks, although bets still reflect twice as high a chance of a rate cut as none.

A clutch of Federal Reserve bank presidents on Friday aired their discomfort with the US central bank’s decision to cut interest rates, even as influential Fed Governor Christopher Waller made the case for more policy easing to shore up a weakening labor market.

This yawning divide within the Fed’s policymaking ranks poses a challenge for Mr. Powell in forging a consensus in his final six months as the chair.

While it is not unusual for Fed policymakers to differ on policy, particularly when the economic data is mixed, the frank expression of that disagreement and the explicit focus on what the Fed ought to do at its next meeting, on Dec. 9-10, was striking.

Despite the US central bank’s cautious tone, both analysts said they still expect the Bangko Sentral ng Pilipinas (BSP) to continue its easing cycle, with another cut likely next month as domestic inflation remains low and amid fragile growth prospects.

“The BSP has been moving independently from the Fed as of late,” Mr. Aquino said.

“However, the magnitude and timing of these cuts might be influenced more by the incoming third-quarter Philippine gross domestic product (GDP) data,” the trader said.

The Monetary Board last month cut benchmark borrowing costs by 25 bps for a fourth straight meeting, bringing the policy rate to 4.75%.

It has now lowered rates by a cumulative 175 bps since it began its easing cycle in August 2024.

BSP Governor Eli M. Remolona, Jr. said further policy easing is possible until next year as they want to help stimulate the economy as they expect a widening corruption scandal involving state flood control and infrastructure projects to affect both public and private investments.

The release of October Philippine inflation data on Wednesday (Nov. 5) and the third-quarter GDP report on Friday (Nov. 7) will be key drivers for the market this week, both analysts said.

“More emphasis will be on the GDP print, as a weaker print could spark a rally on local bonds. Inflation on the other hand still remains well below the BSP’s target; hence, it would not play a big factor,” Mr. Aquino said.

“The GDP report will likely provide more clarity to the BSP regarding the amount of monetary support it needs to deliver in order to sustain local economic growth momentum despite headwinds from the corruption probe and the potential adverse impact of dimming business and investor sentiment on the capital formation and household spending portions of the GDP,” the trader added. — Pierce Oel A. Montalvo with Reuters