Huawei’s Yang Chaobin on 5G-A, AI and Inclusive Connectivity

Key Insights (AI-assisted): Positioning 5G-Advanced as a bridge between current 5G and 6G clarifies how operators can monetize AI traffic growth before 6G standards are finalized. Emphasis on U6 GHz and uplink performance signals a shift in radio-planning priorities, favoring AI-heavy

5G Killer App: Precise Location Without GPS

Key Insights (AI-assisted): Network-side centimeter positioning reframes 5G from a connectivity layer into a spatial intelligence substrate for IoT. Decoupling location from OS and device OEM control shifts bargaining power to operators and systems integrators, enabling cross-vendor, cross-domain asset visibility. This

NTT DOCOMO BUSINESS and Airlinq Partner on Global IoT

Key Insights (AI-assisted): The partnership underscores how regulatory fragmentation has become a primary bottleneck for scaling cross-border IoT, especially in mobility. By productizing regulatory compliance and local-carrier orchestration, it shifts value from pure connectivity resale to governance, lifecycle management, and policy-aware

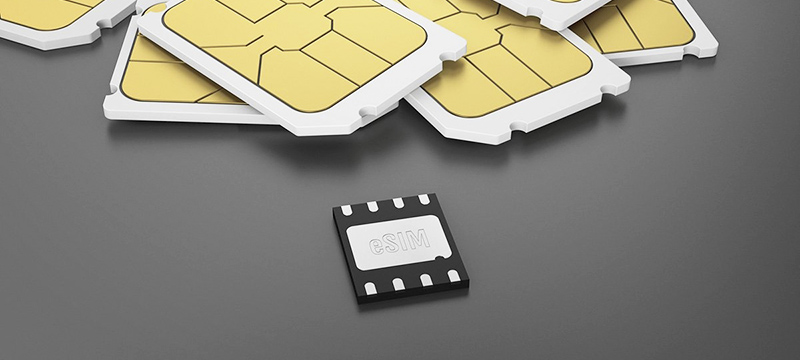

TCA Members Confirm Acceleration of Global eSIM Growth in 2025

Key Insights (AI-assisted): The acceleration of eSIM shipments alongside resilient traditional SIM volumes signals a protracted hybrid connectivity phase for IoT deployments. For device makers, rising SGP.32 support lowers lifecycle and logistics costs by enabling more flexible, remote provisioning models at